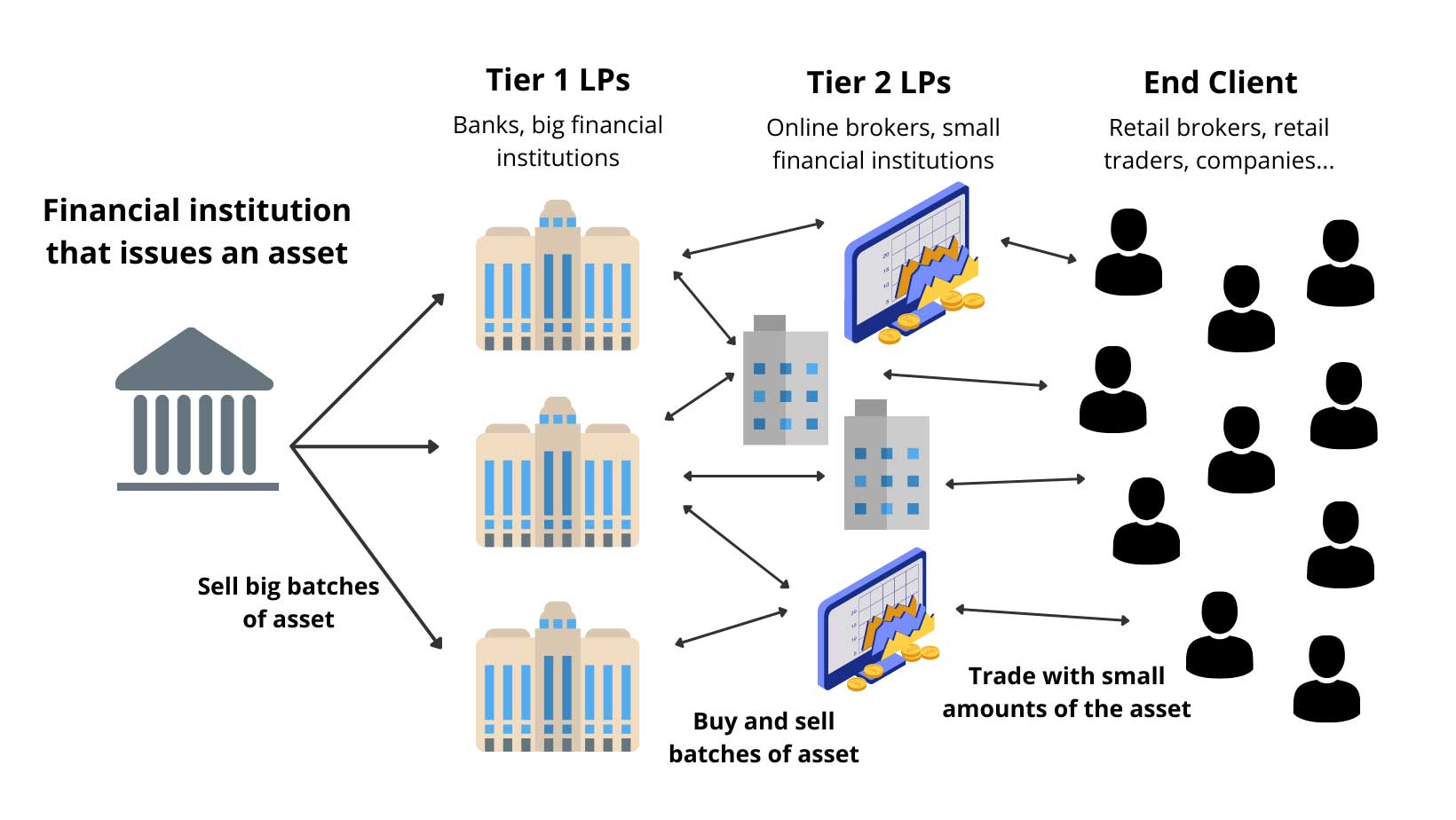

As more and more people adopt cryptocurrencies, it is imperative that businesses of all kinds support them. This is especially true for those who offer tradable assets such as Forex, CFDs, commodities, and more. Liquidity, which is the number of buyers and sellers in a market, is critical to ensure trades can be executed quickly and at a low cost. As such, a cryptocurrency liquidity provider is an essential partner for any broker that offers these types of services.

Cryptocurrency liquidity provider are financial institutions that provide the funds required to execute transactions on a decentralized exchange (DEX). These companies pour their crypto-assets into a ‘pool’, which then allows traders to conduct cryptocurrency swaps through the pool using the two token pairs deposited.

As a result, the provider earns a fee from users who utilize the pool for these swaps.

Uniswap, for example, is a popular DEX that uses a liquidity pool. The platform is well-known for its low trading fees (0.1% for DAI/ETH) and discounts for users who pay with its native cryptocurrency, Binance Coin (BNB).

Liquidity pools enable DEXs to trade at real-time market prices and are a critical component of the DeFi ecosystem. Without them, a DEX would be like a fast-food restaurant without cashiers. Traders can place orders and complete transactions much faster with liquidity pools than they would on a traditional DEX.

Also Read: HitBTC Bot Review

In addition, liquidity pools eliminate the need for market makers and increase user trust in cryptocurrencies and DeFi at large. By providing liquidity, they also reduce the likelihood of price manipulation by a single seller or buyer, which is possible on centralized exchanges.

A potential drawback of liquidity pools is that they expose liquidity providers to temporary loss. This is because the value of the assets added to a pool can decrease in comparison with their initial deposit amount. For example, if one deposites DAI into a pool that initially holds ETH, the value of the DAI will decrease as ETH appreciates in price.

However, most DeFi liquidity pools have publicly viewable smart contracts that are audited by independent parties to ensure that security protocols are followed. This helps to reduce the risk of hacking exploits that can cause losses for liquidity providers.

Also Read: Bitcoin for beginners guides to understand more about cryptocurrencies!

Additionally, liquidity pools allow for the monetization of crypto-assets through rewards, interest payments, and yield-farming strategies. However, the lack of a central authority or custodian for the assets deposited in a pool creates a risk that they may be permanently lost.